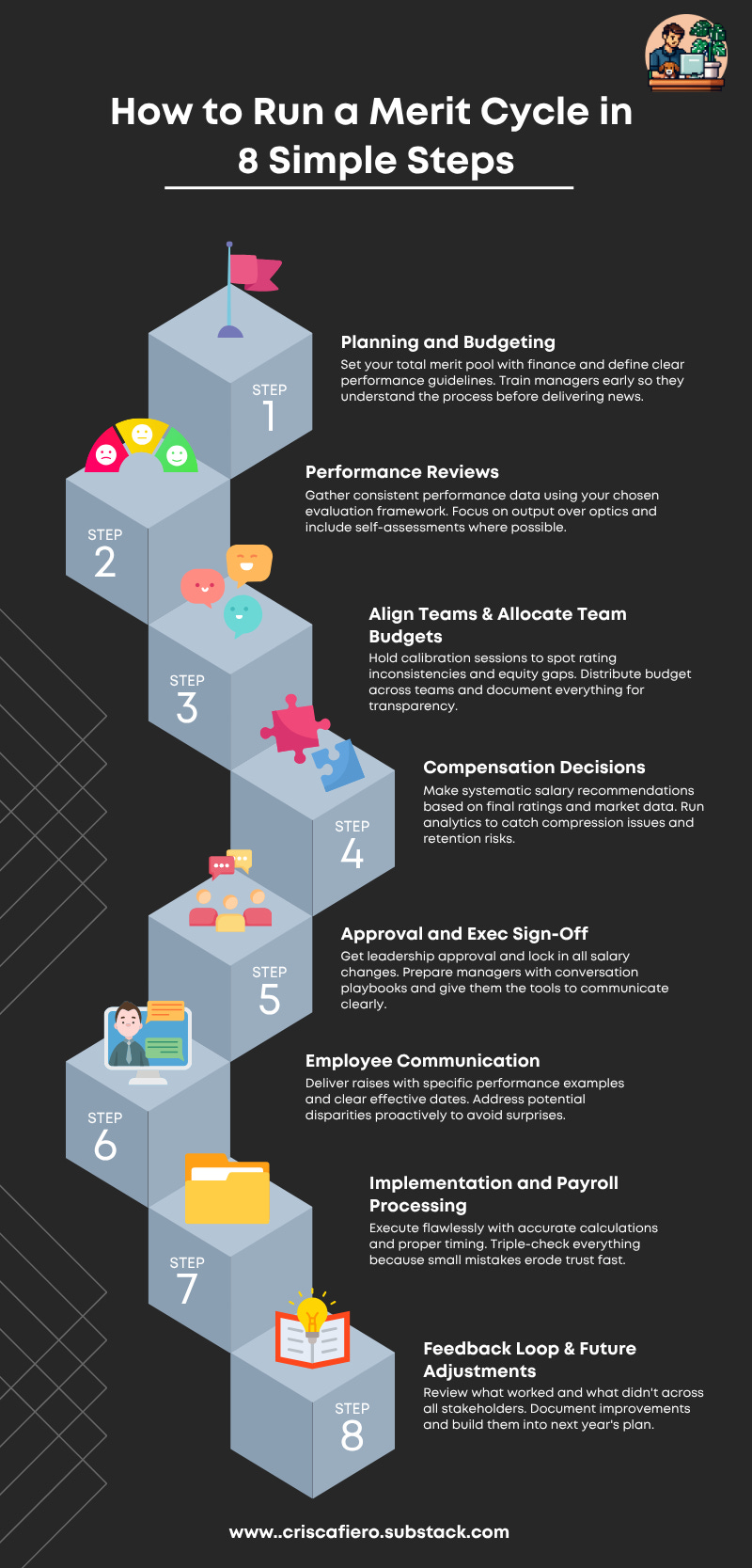

How to Run A Merit Cycle in 8 Simple Steps

A out-of-the-box guide for finance and people leaders running their first (or next) merit cycle

After a year of layoffs and stiff competition for AI talent, I’ve watched as startups stopped bumping up salaries for the sake of it.

They're using merit cycles to reinforce stability and reward key contributors. Top performers are watching what you reward and how you do it, so – it’s safe to say – getting it right is important.

Here’s an 8-step breakdown of how to run your merit cycle:

1. Planning and Budgeting

3-6 months before merit increases

This is where most merit cycles break before they start: nobody agrees on what's available to spend.

Work with finance to set your total merit pool. Most companies consider three core inputs:

Revenue growth

Market benchmarks

Cost-of-living trends

Finance typically proposes a budget as a percentage of total payroll (tends to be around 3-5%), while HR shapes distribution.

Companies in 2024 maintained steady merit budgets regardless of size — just under 4% across the board, with SMBs lagging a bit by half a point. Not to be outdone, AI companies boasted 5%+ increases across all levels, driven by aggressive funding and talent competition.

Now define your merit guidelines based on performance. I see most companies use a flexible percentage range where top performers get ~4-5% while average performers receive 2-3%, or a merit matrix approach that factors in both performance and current pay relative to market midpoint.

Then set eligibility criteria clearly. As an example:

Minimum six months tenure

Meets baseline performance standards

Not on a performance improvement plan (PIP)

Write this down and get your managers familiar with it. Don't wait until they're delivering news they don't understand. If employees ask questions they don’t have the answers to, there will inevitably be issues.

Simplified: How much do we have to give, why do we give it, who qualifies, and who doesn’t?

2. Performance Reviews

1-2 months before merit decisions

This is where you gather performance data to guide raises, whether from formal ratings, manager judgment, or peer feedback.

This is a specific “company culture” thing. Some startups have dropped traditional ratings entirely. The key is consistency across your evaluation framework, whether you use manager-led assessments, peer feedback, self-assessments for context, or open-ended feedback with simple recommendations.

Include self-reflection where possible. Keep the process consistent and fair. HR should oversee the cycle to maintain evaluation standards and catch potential issues early.

Simplified: How do we rate and who determines the rating? Now collect feedback.

3. Align Teams & Allocate Team Budgets

4-6 weeks before finalizing increases

Hold calibration sessions with HR business partners, department heads, and senior managers. Compare performance ratings across similar roles and discuss context around high or low performers to avoid bias.

Watch for these red flags:

High performers who've been overlooked for increases (turnover risk)

Teams with suspiciously inflated rating distributions

Noticeable differences in recommendations across similar roles

Pay equity disparities across gender, race, or other demographics

Allocate budget across teams based on size, performance distribution, role criticality, and market alignment. Always, always, always document your rationale. Clear records of equity checks maintain compliance and reinforce fair pay commitment – but they also make your team feel good about the transparency of the process.

Simplified: Align the team expectations, give them strict budgets, know what discrepancies to look for, and document everything.

4. Compensation Decisions

3-4 weeks before merit increases

This part should be systematic, not political.

Managers or merit-owners recommend salary adjustments based on final ratings. HR reviews recommendations for policy and budget alignment. Compensation teams run analytics to confirm fairness across demographics.

Look for compression issues, market drift, and retention risks. The data should tell a clear story about who's getting what and why. If it is political, you’ll know it – and you can address it.

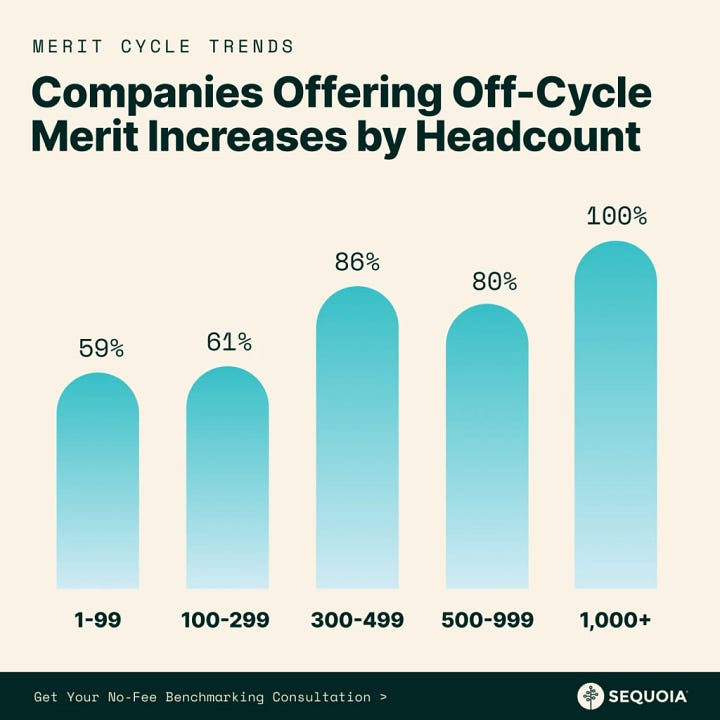

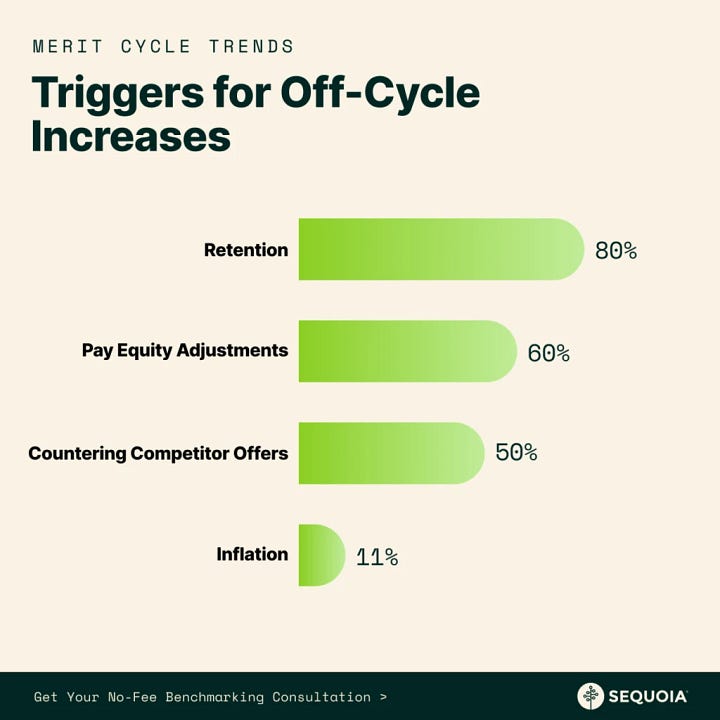

Off-cycle raises are now standard practice. I’m seeing 80% percent of companies use them for retention – up from 50% the previous year. Nearly half of companies under 100 employees rely on them. Remember: you can use them to stop a leak, but they won’t hold the whole dam.

Simplified: Ratings are confirmed, compensation team checks for gaps, send off for approval.

5. Approval and Exec Sign-Off

Up to 2 weeks before implementation

Senior leadership reviews the full picture. Their role is confirming overall spending fits the approved budget and compensation decisions support retention, equity, and business continuity.

Lock in salary changes once leadership approves. Run a final accuracy check – yes, I know we’ve done this already. But even small mistakes erode trust fast. It doesn’t hurt to triple check.

Prepare managers for upcoming conversations. Give them a playbook covering how to explain specific raises, how to handle "Why not more?" without panic, and how to avoid referencing peers directly.

Whatever you do – please – don't let them say, "I fought for you." It undermines the process and throws the rest of the team under the bus. There are pay ranges to adhere to, people.

Simplified: Execs rubber stamp, managers are prepped & ready.

6. Employee Communication

1-2 weeks before implementation

Managers meet one-on-one with each team member. Cover three things:

New salary and effective date

Connection between raise and performance

Relevant context around team or budget factors.

Be direct and thoughtful. Vague praise won't land well, especially if the raise disappoints (“you’ve done such a great job, here’s 1%”). Use specific examples from performance reviews to guide the conversation.

Address any perceived disparities ahead of time. Compensation decisions don't happen in a vacuum. If two people receive different raises, questions will arise. Give managers tools to respond with clarity by reinforcing how compensation ties to performance and acknowledging when business factors shaped outcomes. Clear expectations = no surprises.

Follow up with formal documentation/acknowledgements outlining new base salary, effective date, and any changes to compensation bands.

Simplified: Deliver the news.

7. Implementation and Payroll Processing

Final week before increases take effect

Merit increases lose impact if employees don't receive them in full and on time. You won’t get any bonus points for running a successful payroll (sorry, payroll admins. It’s a thankless job) – but you’ll hear it if you don’t.

Enter all salary changes into HRIS and payroll tools. Pay attention to effective dates matching payroll cutoffs, accurate percentage calculations, currency consistency for global teams, and adjustments tied to bonuses or incentives.

Run final checks comparing new salaries against manager recommendations, scanning for entry errors or formatting mismatches, confirming no duplicate or missing changes, and verifying timelines won't disrupt processing.

Confirm changes with workers through pay stubs or dashboards showing updated compensation and effective dates.

Simplified: If you’ve read this far (thanks, by the way) you’re probably catching onto the theme: there’s a lot of quality assurance. Take your time with this.

8. Feedback Loop & Future Adjustments

1-2 months after implementation

A good merit cycle ends with feedback.

Some questions you can use to examine your outcomes:

Did spending stay within the planned pool?

Did high performers get the strongest increases?

Have you improved market positioning for underpaid roles?

Any unexplained differences across demographics?

Did some managers apply guidelines differently than others?

Gather feedback from everyone: HR, finance, managers, and employees. Ask questions beyond logistics about manager confidence, guideline clarity, employee understanding, and team conversation challenges.

Document (are we sensing a pattern yet?) what needs to change. Use this to inform next year’s plan. If decisions felt rushed, shift cycle timelines. If equity issues emerged, review tracking during calibration. If performance ratings didn't drive outcomes, rethink input mechanisms.

Simplified: How’d we do? How can we be better?

Here’s How We Run Merit Cycles at Sequoia

We built Merit Planning directly into Comp OS, so you can segment employees by department, geography, role type, or leadership level. Track eligibility, promotions, and comp spend across those groups. Enter performance ratings tied to your review system. Adjust salary, bonus, and equity using contextual data. See how changes land within your defined pay ranges.

Push updates directly into their HRIS, equity admin, or payroll system. Generate and distribute personalized merit letters in-platform. Collect employee acknowledgment — no paper, no PDFs, no guesswork. For clients on Sequoia One PEO, it’s all-in-one.

Easy.

By assigning clear roles and permissions, you keep both financial and people priorities aligned from start to finish. When it's time to tell the story, everyone's on the same page (and speaking the same language).

Want to see how your merit cycle compares to your peers?

Shoot me a note:

If you found this useful, check out my other articles.

In this newsletter, I share how real startup teams:

Set pay ranges

Build job levels

Benchmark comp data

Refresh employee equity

Measure engagement

Offer wellbeing perks

Handle layoffs and severance

Just what’s working — and what’s not.

Subscribe to get the next one.

Or share with someone building their people strategy.

Talk soon,

Cris Cafiero

Startup People Spend

Business Consultant @ Sequoia